Investment advice in a digital world

Innovative advisory software for financial institutions.

Innovative financial technology

We design technology that is built around your customer. The building blocks are solid and proven, whilst the customer journey is smooth and can be completely customized by your IT team, or by us.

Digital with a human touch

We believe that it's for the customer to decide. Some value human interaction and trust relationship with an adviser, while others prefer managing their money from their sofa, in complete autonomy. Our modular approach allows adapting to the specific needs of your client audience.

Why financial institute work with us

We deliver fast and adapt quickly

Advanced modular technology

and proven security

Global experience in large and

small projects

Academic background,

scientific robustness

Corporate culture

B2B first, with B2C experience

The technology

.png?width=672&height=400&name=Rectangle%2026%20(1).png)

Modular

Open API

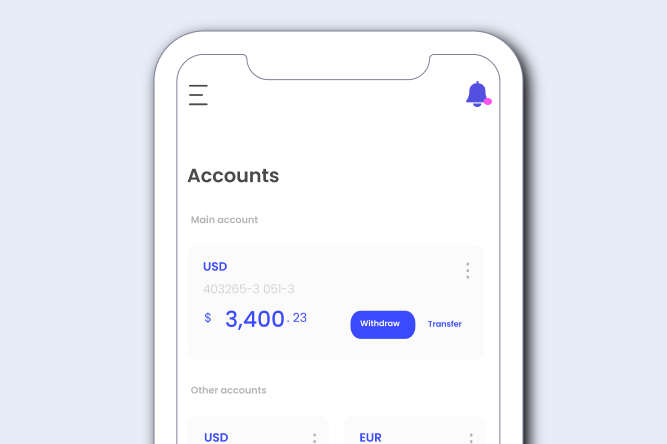

Omni-channel and mobile first

Regulatory compliant

More than software

Cloud ready & secure

Modular marketplace

We have a component and micro-services based approach for faster customization and cheaper deployment costs.

The technology foundation composed of a hub with APIs, is highly scalable. It reduces integration time and allows easier integration of third-party applications.

So our clients can choose to start with quick wins or to build with us a complete end-to-end solution that fits their specific expectations and business model.

.svg)