Solutions

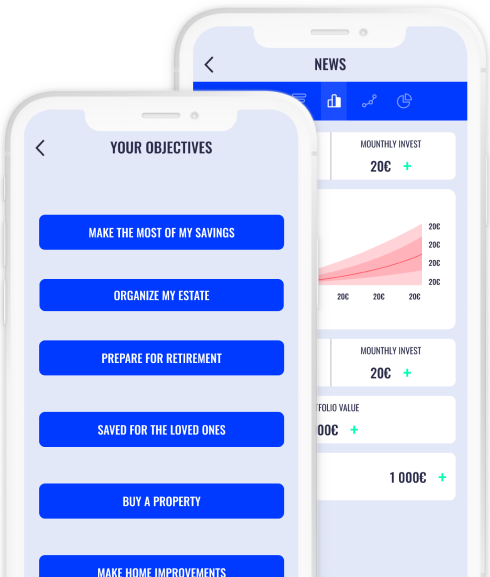

Innovative advisory software for financial institutions.

One-size-fits-all technology

Different client segments require different propositions. But one thing they all have in common is the need to go digital. Banks have struggled to service segments such as the mass affluents efficiently and how to industrialize wealth management.

Thanks to its common platform and modular structure, Gambit can help banks deploy multiple customer journeys based off the same platform: simple, advanced and advisory robo, face to face advisory: the core platform can optimally and efficiently support all client segments while being declined to the specifications of each one.

Benefits of this approach include economies of scale, faster time to market, investment strategies aligned to each segment, differentiated customer digital experience, increased revenue streams and customer loyalty.

Type of interaction

Type of management

Level of personalisation

A customized solution using standard bricks

Robo-Advisor

Advisor-Guided investment

Pension platform

Advice communication

Asset management platform

.svg)