Pension platform

Bring the future to the present

Give your clients the gift of looking into the future to see how their wealth will evolve once they retire, and how they can secure a better retirement plan. Once they've analysed their current lifestyle and their lifestyle expectations during retirement, identify the pension gap, see how their assets - both investments in financial markets as well as real estate and other investments - will evolve and provide them with value-adding investment advice to secure their retirement goals.

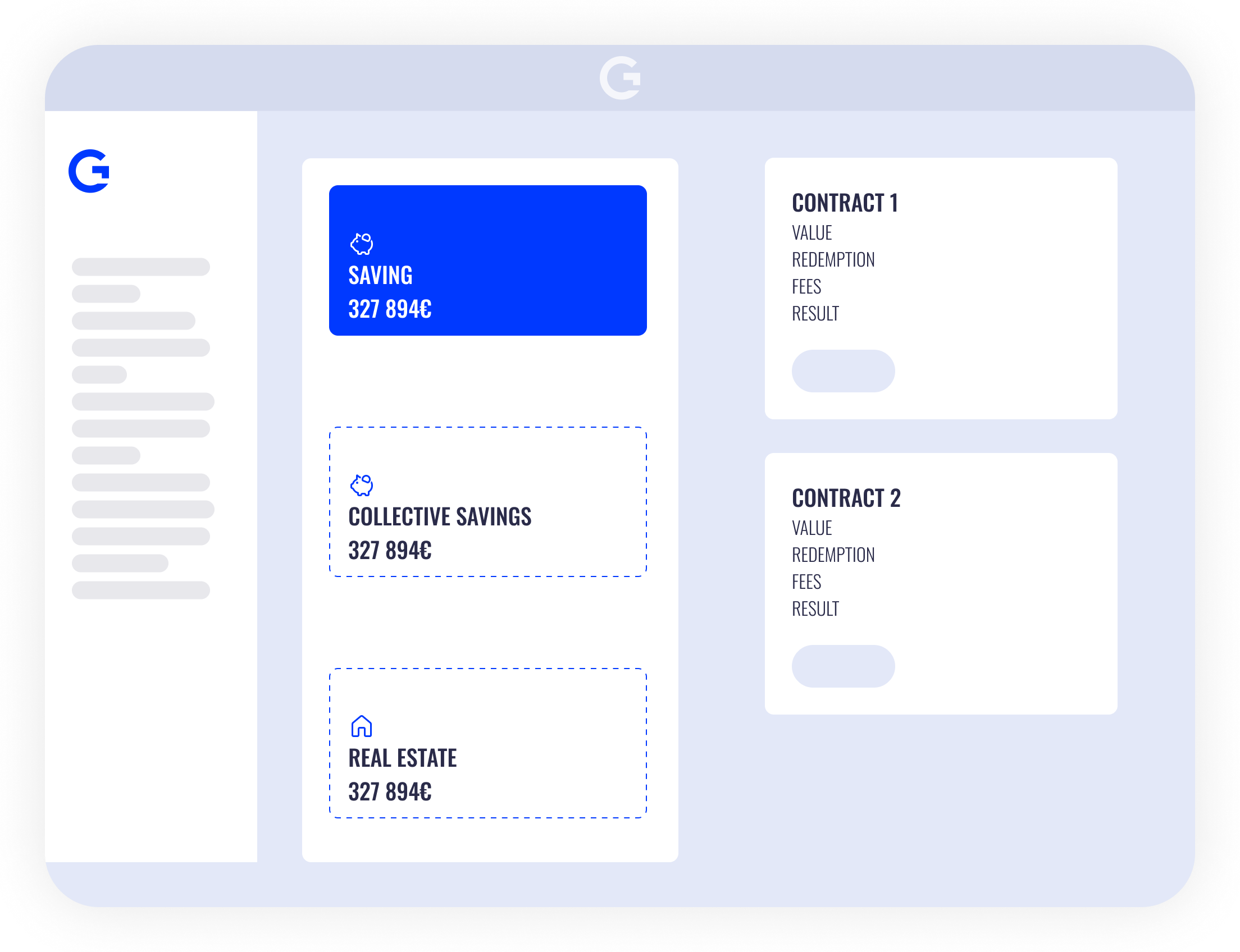

360° Overview

The first step to analysing the evolution of the clients' global wealth is to gather information on all of their assets. This means assets and loans held at your bank, but also investments and loans held in other financial institutions, as well as non-financial markets investments, such as real estate.

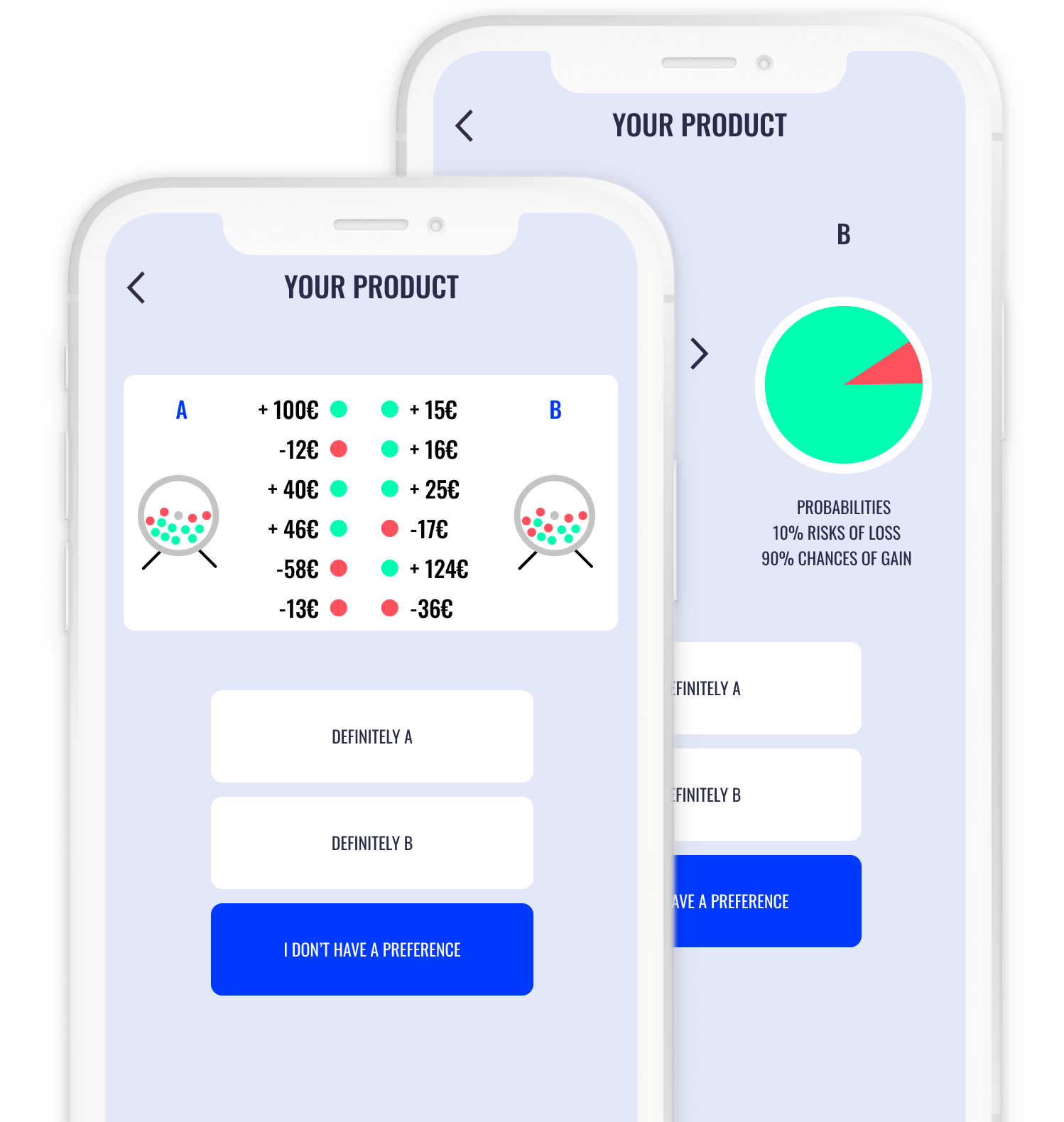

Risk profiling

Comprehensive understanding of client characteristics/preferences in terms of retirement project horizon, retirement income, current and future taxation, investment (risk, etc.), wealth, inheritance objectives, etc

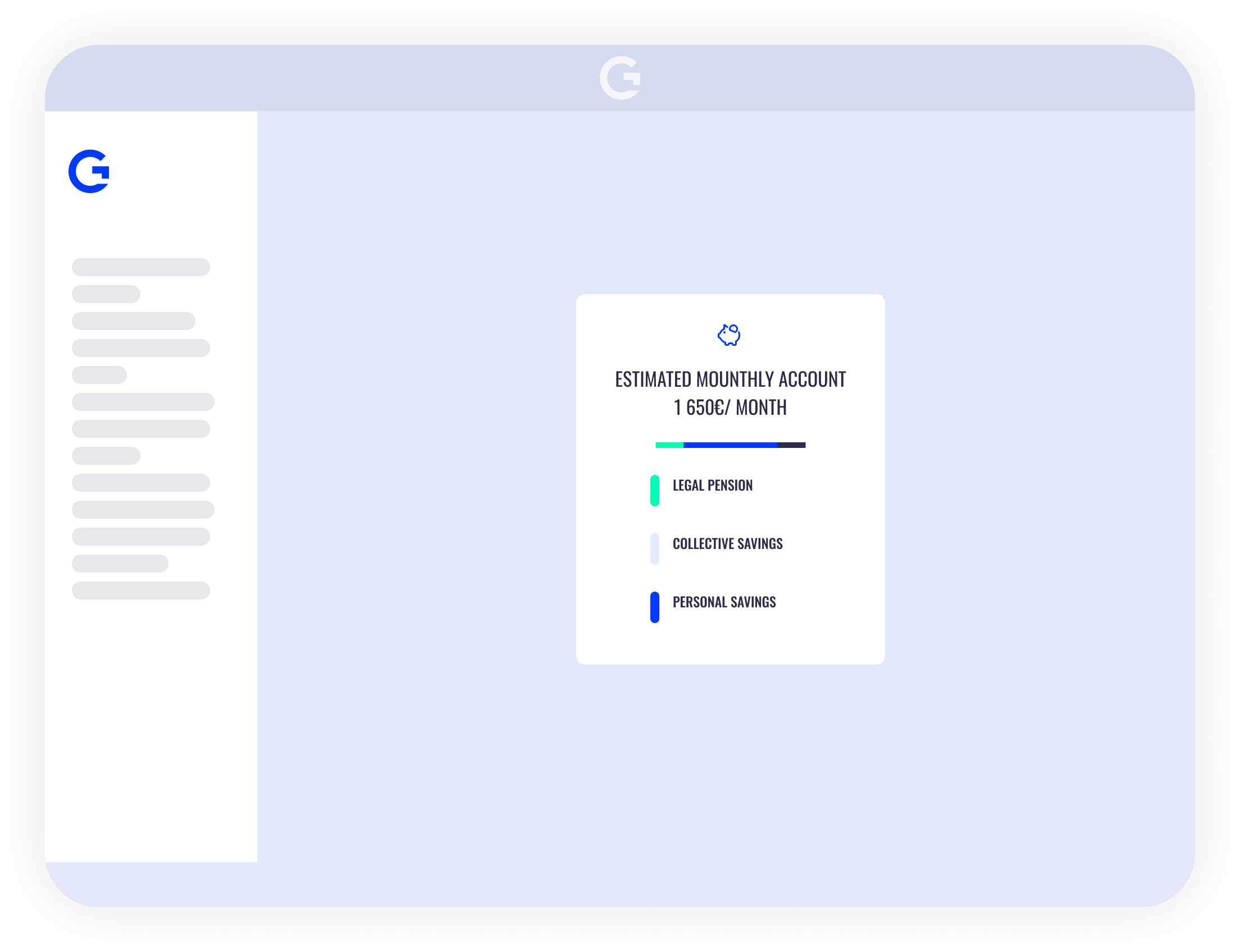

Pension projections

Simulate the evolution of the client's wealth over his active lifetime, when his wealth is accumulating, followed by the evolution of his wealth once he reaches retirement, when his wealth is probably decumulating. See how the simulations would change if he invests some of his accumulated wealth, all the while ensuring investments are made in investment vehicles that are in line with his investor risk profile.

Decumulation phase

Projections are often focused on the accumulation phase, but neglect the disinvestment period. During the decumulation phase, the accumulated wealth is consumed progressively due to reduced income. It provides a view when assets will dry out, or when real-estate needs to be sold to guarantee the quality of life.

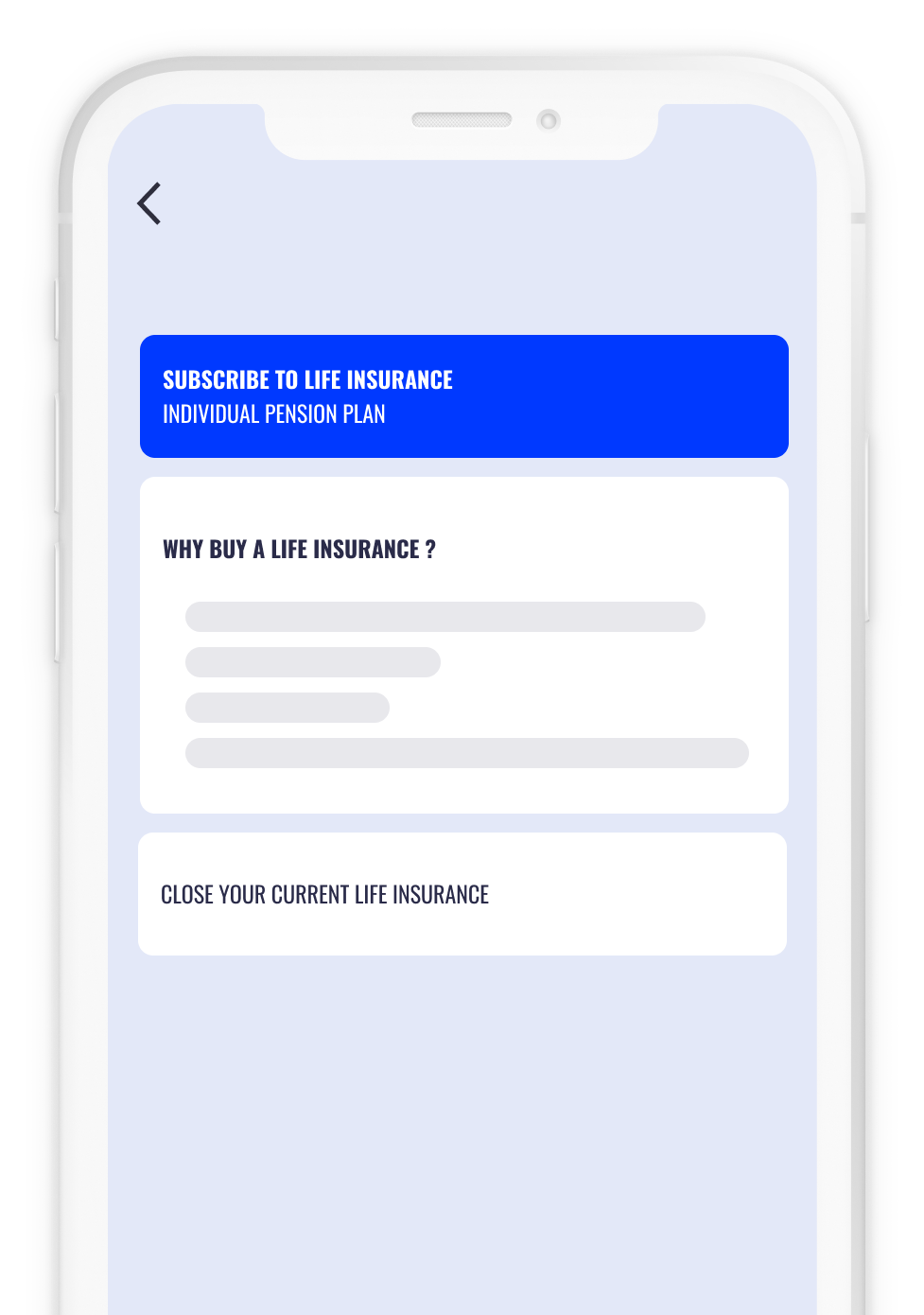

Enveloppe advice

Ensure clients benefit from recommendations that take into account the fiscal benefits of various investment vehicles and products.

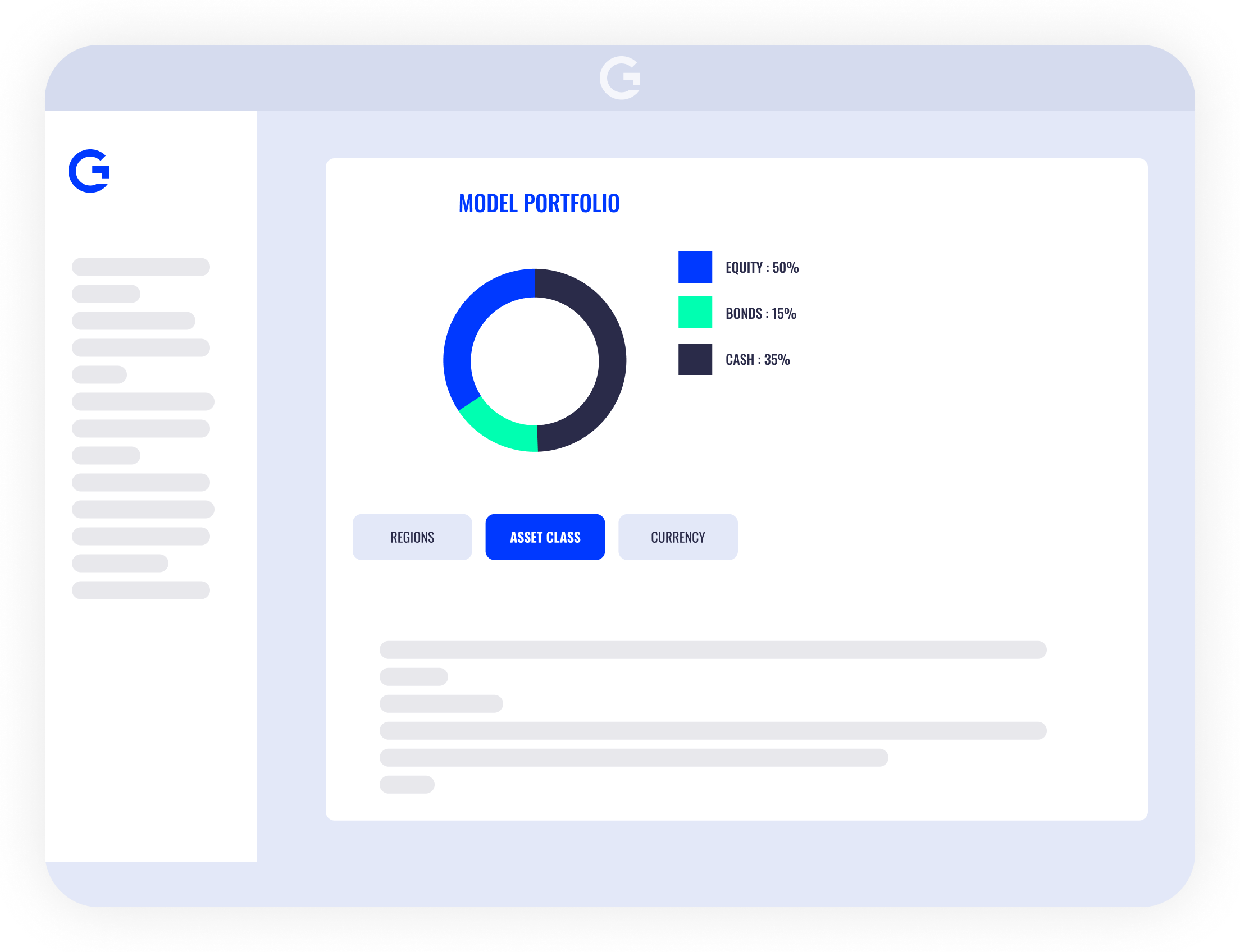

Your platform, your rules

The investment universe - i.e. the eligible products-, the priority lists, asset classes, categorisation, risk constraints and many other parameters - are configurable by the head-office. Benefit from a platform that allows you to build a unique proposal engine that corresponds to your view of the market and how you want to serve your clients.

.svg)