Beobank is part of the Credit Mutuel Nord-Europe group located in France. Beobank's investment strategy is a key element in the development of the bank. Together with Beobank we have developed a digital

investment advice solution based on the methodology bellow:

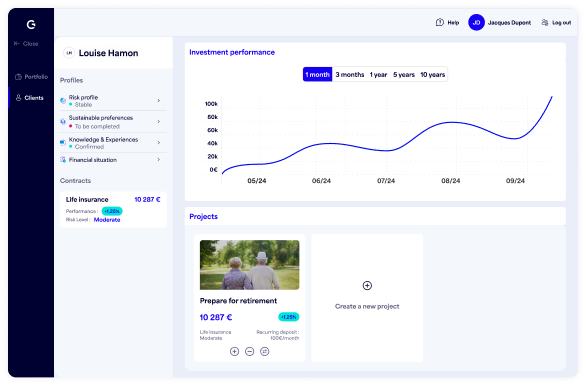

- 365° personal financial situation

- Asset allocation based on 3 pockets distribution: Cash, Protection, Growth Investor profile (based on risk profile, investment horizon, knowledge & experience)

- Investment proposal (based on the model portfolio of the bank)

- Signature and buy process

- Quarterly wealth management statement and yearly follow up

.svg)

%201.png?width=552&height=361&name=Robo%20Advisor%20Illustration%20(2)%201.png)