Gambit modules

Leading the way in investment with our innovative API technology. Experience the power of investment API integrations that are fast, secure, and future-ready.

Cracking the code : Gambit Toolbox

Enjoy a seamless digital transformation for your investment offerings with our innovative, flexible, cloud-based toolkit, specially designed to optimize your services for various customer segments. Transform how you serve different customer segments with modular tools that accelerate launch while enabling deep customization.

With our suite of white-label Gambit solutions, you can build the future of your investments.

Fluid and secure, our APIs enable banks and insurers to rapidly expand their product offerings with agility and efficiency. By leveraging our solutions, they can proactively adapt to the digital landscape, stay ahead of the curve and thrive in today's ever-changing digital environment. All you have to do is choose what you need! Our white label investment platform lets you focus on strategy while we handle the infrastructure.

1 Onboarding

KYC *

Propsection proposal

Risk profiling

Sustainability preferences

Knowledge & experience

2 Advice

Goal Based Advice

Patrimony

Investible amount & buffer

Envelope Advice

Service type advice

Allocation proposal

3 Execution

Portfolio construction

Subscription

Rebalancing

Virtual account

4 Personalised monitoring

Dashboard

Performance

Reporting

*only user interface

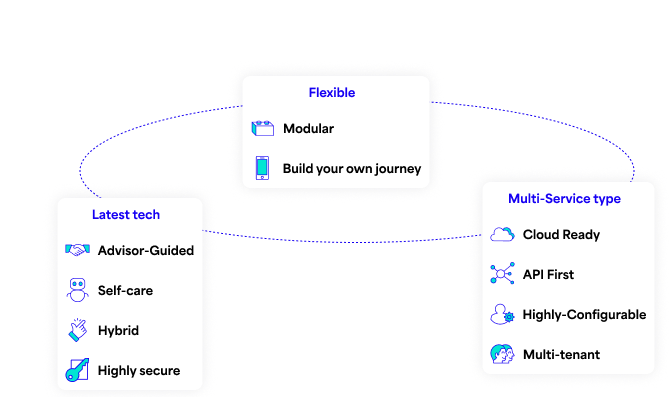

Competitive advantages

1. Comprehensive tools

The essential building blocks for setting up an investment advisory or portfolio management service, whether self-guided or advisor-guided.

2. Fast implementation

Using state-of-the-art technology, including an API-first approach and cloud, it is possible to combine modules with transparent integration both in the front (screens) as well as back (data). This investment API design ensures fast deployment with minimal disruption to existing systems.

3. Global mutualization, local configuration

All modules have been designed to support multiple use-cases, by allowing a local configuration for your specific workflow. The multi-tenant architecture allows for a secure separation of data.

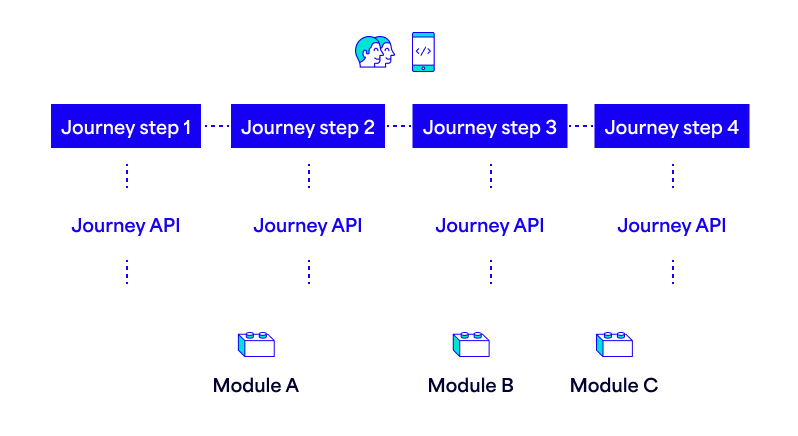

Tailored to fit your needs

Customer journeys are adapted for each implementation, whilst keeping the building blocks the same.

Allowing you to create your own journey

Packaged per “Value stream”.

API-First

REST-ful APIs with independent lifecycles enable fast, easy integration and provide the agility to scale and evolve your offerings.

Cloud Ready

Our product is built for the cloud, allowing you to choose your preferred provider, or to opt for our SaaS solutions.

Highly-Configurable

Each financial institution has its own services, product offering, rules and operational specificities. These are managed through configuration, not hard coding.

Multi-Tenant

Our multi-tenant architecture allows for hosting multiple isolated entities within the same platform.

Highly Secure

The financial industry is built on trust. Our product meets the highest and latest security standards.

FAQ

Gambit’s technology is built for financial institutions, including retail and private banks, insurers, asset managers, and digital/fintech “neo-players.” It is ideal for organisations looking to offer digital investment advisory, portfolio management, or wealth-management services.

Gambit’s API-first architecture enables flexible integration of its modules into an institution’s systems. Institutions can select only the functionalities they need, embed them into their own front-end or back-end workflows, and deploy quickly through a cloud-ready platform. This approach allows rapid customization and reduces IT overhead.

Gambit’s modular, microservice-based design supports seamless integration at both the data/back-end and user interface layers. Modules are configurable to match existing workflows, product offerings, and compliance requirements. Multi-tenant deployment and high security standards ensure safe integration across different business lines or subsidiaries.

Yes. The platform supports a wide range of digital investment use cases, including:

- Self-guided robo-advisor journeys

- Advisor-assisted client interactions

- Discretionary portfolio management

- Multi-product or multi-wrapper environments

- Services for multiple client segments, from retail to private banking

.svg)