Article by Ken Van Eesbeek, Head of R&D at Gambit.

We launched Birdee in 2017, with a simple vision: to make money a better support for what comes next. We wanted to execute on this vision both directly with our B2C robo-advisor ( Birdee Money Expert ), and indirectly through our B2B business line. By getting first-hand market insights and live testing of our functional and technology innovations, we have been able to help our institutional clients build better and faster solutions that meet their client’s expectations. Walking on the B2C and B2B legs was always essential to us as we believe innovation brings extra value when it is shared. In a series of articles, we focus on some interesting findings that could help other companies when starting an online savings and investment advisory service.

This week: The profile of Robo-advisor users: some of our learnings (part 1)

An average robo-advisor user profile?

A topic that is always discussed at length when a firm considers launching a robo-advisor and is continuously on the table after the new service launch, is the profile of the robo-advisor users and their expectations. Answers to this topic regularly come from often biased- intuition, self-designated digital experts or polls. Thanks to our two-legs strategy, we can provide some answers, suggested by our users’ behaviour on our B2C application. We only provide a partial answer as the profile and expectations of robo-advisor users will be influenced by several key choices made by the firm, like its positioning on the market, its key messages, its tone of voice, etc.

Market Positioning

At Birdee, in 2017, beside intuitiveness, we opted for the following positioning: a service open to everyone, irrespective of one’s wealth and expertise in finance, a service that everyone can test before subscription, a service where one can invest with a goal and where money is always available in a few clicks. We chose to use a simple language, away from the traditional jargon and educational expertise of many wealth and asset management companies, and we put in place a dialogue in which return is only one amongst several subjects of discussion. Finally, we have also decided to make no large marketing campaign, focusing on influencers and very limited digital marketing. Although we keep adjusting Birdee’s positioning in accordance with our retail clients’ feedback, our ecosystem, the technology innovations and, of course, the regulation requirements, we listed in the following paragraphs some lessons learned so far from our experience in Belgium, France and Luxembourg. We only present figures and leave their interpretation open for further discussion.

Birdee is a service open to everyone, irrespective of one’s wealth and expertise in finance. It is a service where you can invest with a goal and where money is always available in a few clicks.

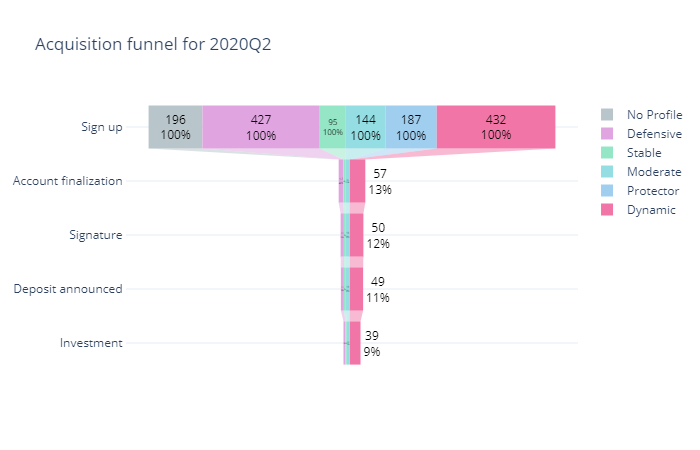

The acquisition funnels

In terms of clients’ acquisition via the application, the vast majority of prospects drop out during the account finalization stage. However, during the next stages before funds are actually deposited, the dropout rate is limited to a couple of percentage points.

Across the registration-to-investment process, the dropout rate is significantly lower for users above 4O years old. And if lowering the minimum investment amount from € 1000 to € 50 multiplied more than tenfold the number of signups by users younger than 25, their dropout rate is the highest during the next stages of the process, and even more if they are women.

Across the registration-to-investment process, the dropout rate is significantly lower for users above 4O years old. And if lowering the minimum investment amount from € 1000 to € 50 multiplied more than tenfold the number of signups by users younger than 25, their dropout rate is the highest during the next stages of the process, and even more if they are women.

Portfolio distribution since we moved to 50€min:

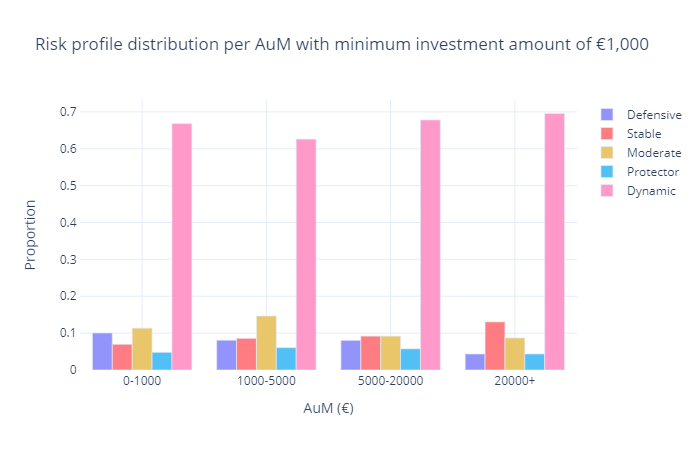

The average profile of our users is a man of around 42 years old with a dynamic risk profile, and an average monthly income of € 3.000.

Surprise and diversity

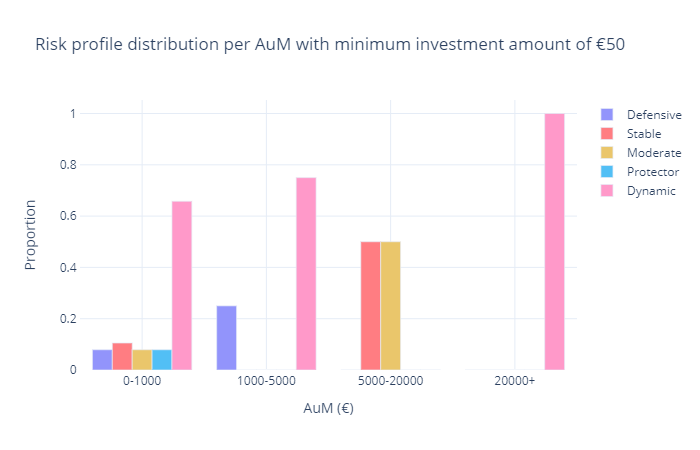

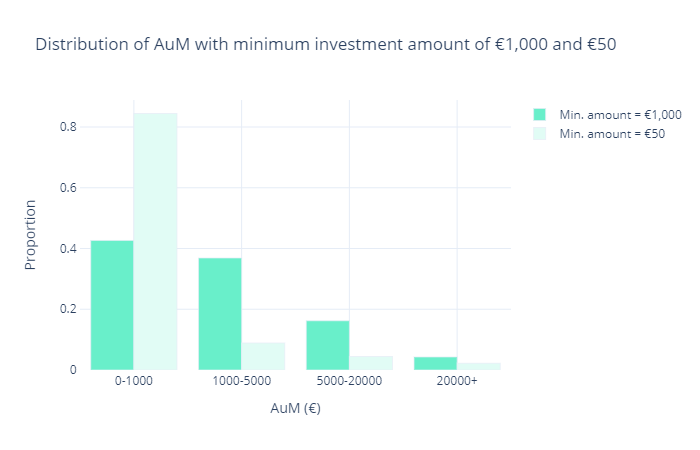

This leaves an investor profile that does not resemble what we would intuitively expect for a Fintech. However, it is substantially more diversified than what we see at many financial institutions. The average profile of our users is a man of around 42 with a dynamic risk profile, an average monthly income around € 3.000, and no well-defined investment objectives beside doing better than his traditional savings account. When the minimal investment amount is lowered, the average age drops to 30 and the users’ average risk profile is more prudent. However, users are more comfortable using direct debit transfers to fund their portfolios. They also go more rapidly through the process from showing interest to opening an account and finally to investing money in a portfolio. Although the number of portfolios with an AuM of € 1.000 or less doubles, the average cash-in per new subscriber remains above € 1.300.

The AuM distribution since we moved to 50€ minimum:  We observe that the distribution of the range of 0-1000€ ( AuM on portfolio) doubles. How do our users view their investments? What are their objectives? How do they match their single risk profile with their portfolios preferences? How do they react to turbulences and what do they expect from their robo-advisor?

We observe that the distribution of the range of 0-1000€ ( AuM on portfolio) doubles. How do our users view their investments? What are their objectives? How do they match their single risk profile with their portfolios preferences? How do they react to turbulences and what do they expect from their robo-advisor?

Lowering the minimum investment amount from € 1000 to € 50 multiplied more than tenfold the number of signups by users younger than 25. However, their dropout rate is the highest during the next stages of the process, and even more if they are women.

Again, based on our data, we have now information that can guide firms willing to offer robo-advisory services to design the right offering with the right operations and realistic expectations. We will cover these topics in upcoming notes.

.svg)