With the Design Sprint by GAMBIT, we made tangible progress on the sustainable investment: at the end of the 5-day Design Sprint, we presented the project sponsors with a clickable prototype based on in- depth reflections on the recommendation algorithm while taking into account the legal concepts. The methodology helped the project to run smoothly!

Private banks and wealth managers

Stay profitable and adaptable in a competitive, ever-changing regulatory environment.

Identifying the challenges you face

-

Adapting to regulatory changes

Adapting to regulatory changes -

Embracing digitalization

Embracing digitalization -

Competing with independent advisors

Competing with independent advisors

Adapting to regulatory changes

Embracing digitalization

Competing with independent advisors

Automated solution tailored

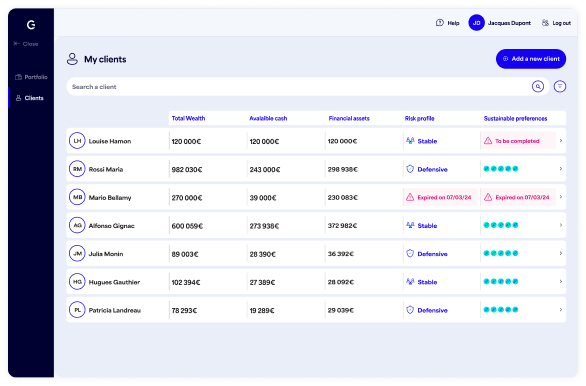

Portfolio Optimizer: Enhance Client Attraction through Personalized Investment Recommendations

Boost client acquisition with our Portfolio Optimizer, offering personalized recommendations and freeing advisors from admin tasks — so they can focus on building stronger, high-value client relationships.

Embrace a solution that liberates your team and enhances your service offerings.

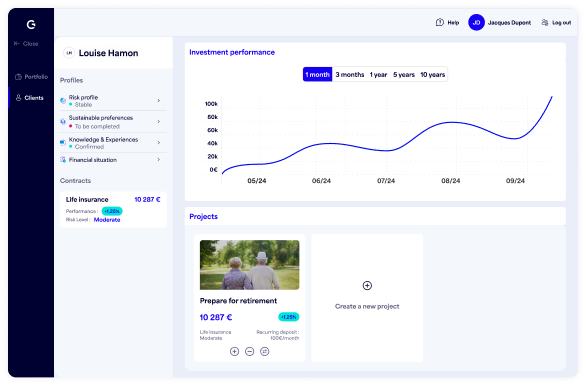

Advisor-Guided Solution

Our Advisor-Guided Solution simplifies the advisory process with AI-powered, personalized recommendations, helping advisors focus on client relationships and clear guidance toward financial goals.

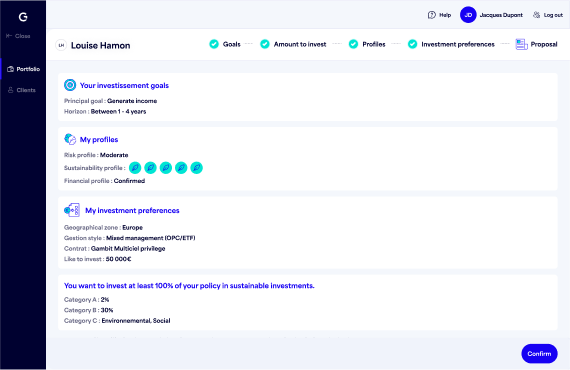

Turn Execution-Only Relationships into DPM Partnerships

Strengthen client relationships by converting execution-only clients into DPM clients, with personalized portfolios, continuous rebalancing, and tailored support to boost satisfaction and loyalty.

What our clients think of our Gambit Solutions

“It was a real added value for the ongoing project!”

Diederik Ampoorter

Head Savings, Investments & Non-Banking Services

“Gambit's role was a key success factor!”

Recent regulatory changes required adaptations to the system for collecting customer preferences for investments. To make these complex adaptations in a limited time, we called on Gambit to benefit from their "Design Sprint" expertise.

Pierre Couillard

Financial Savings Group Initiative

.jpg?width=248&height=165&name=machine-learning%20(1).jpg)

"A good way to get straight to the point and to bring out the best of our ideas"

With the Design Sprint by GAMBIT, we made tangible progress on the sustainable investment: at the end of the 5-day Design Sprint, we presented the project sponsors with a clickable prototype based on in- depth reflections on the recommendation algorithm while taking into account the legal concepts. The methodology helped the project to run smoothly!

Carole Blanc

Business Team Pilot

How can we help?

Ask for a demonstration of one of our solutions.

Click here to visit our career portal.

Do you not know which of our solutions meets your needs, or do you have another request? Let our experts guide you.

Do you want to innovate and have an idea or a project to propose to us? Contact us without delay!"

.svg)