Targeted solutions

Solutions crafted for your unique challenges.

Tailored solutions for specific challenges

Our targeted modules help you address complex use cases with ease, powered by smart, adaptive financial planning software. In a landscape where precision makes all the difference, our specific solutions address clearly defined needs. Designed to support particular situations, they strengthen your offering and deliver concrete answers while maximizing operational performance.

-

Profiling

Profiling -

Proactive Proposal

Proactive Proposal -

Pension planner

Pension planner -

Product and envelope advice

Product and envelope advice -

Portfolio construction

Portfolio construction -

Administration console

Administration console

Competitive advantages

1. Comprehensive toolbox

All the building blocks for the creation of a self-guided or advisor-guided investment advisory or Portfolio Management service.

2. Fast implementation

Using state-of-the-art technology, including an API-first approach and cloud, it is possible to combine modules with transparent integration both in the front (screens) as well as back (data).

3. Global mutualization, local configuration

All modules have been designed to support multiple use cases, by allowing a local configuration for your specific workflow. The multi-tenant architecture allows for a secure separation of data.

How can we help?

Ask for a demonstration of one of our solutions.

Latest News

FAQ

Gambit’s Targeted Solutions are designed for financial institutions, including private banks, retail banks, asset managers, life insurers, and digital/fintech “neo-players.” They are intended to help institutions enhance their advisory, wealth management, and portfolio construction services.

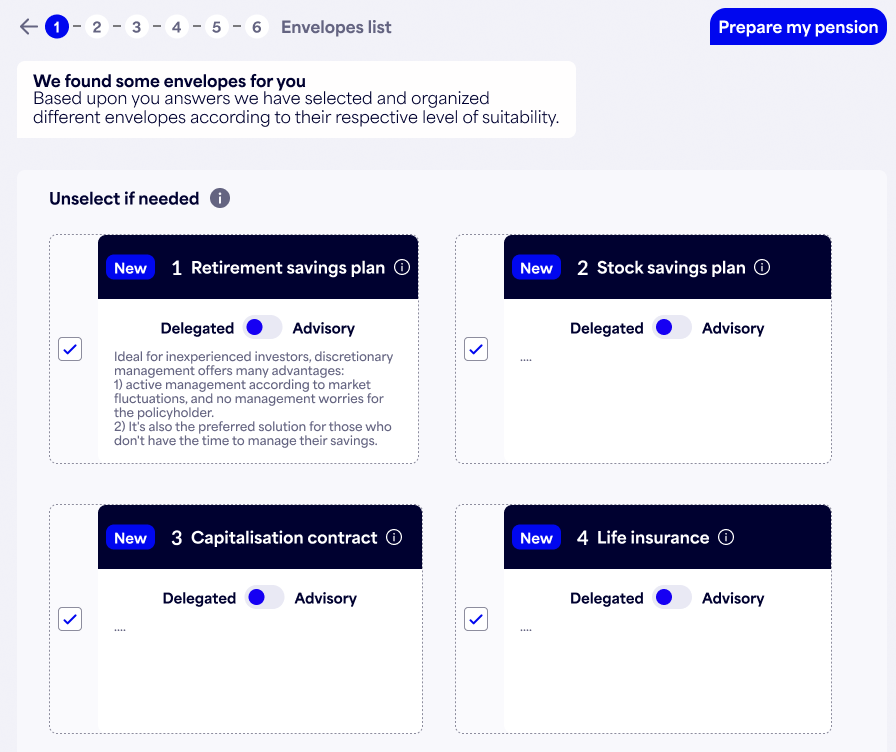

Targeted Solutions offer a modular suite of digital tools, including:

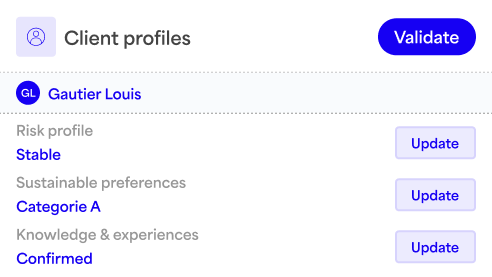

- Investor Profiling – capture financial situation, risk tolerance, experience, and ESG preferences.

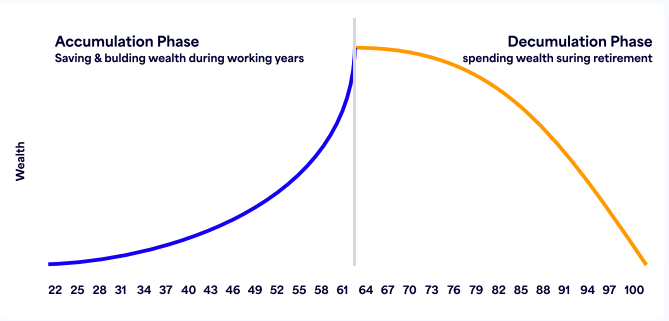

- Financial Planning – map investment paths based on current assets, goals, and buffers.

- Pension Planner – simulate lifetime financial scenarios, pre- and post-retirement.

- Product & Envelope Advice – allocate investments across products or categories.

- Portfolio Construction – build target allocations using quantitative or rule-based engines.

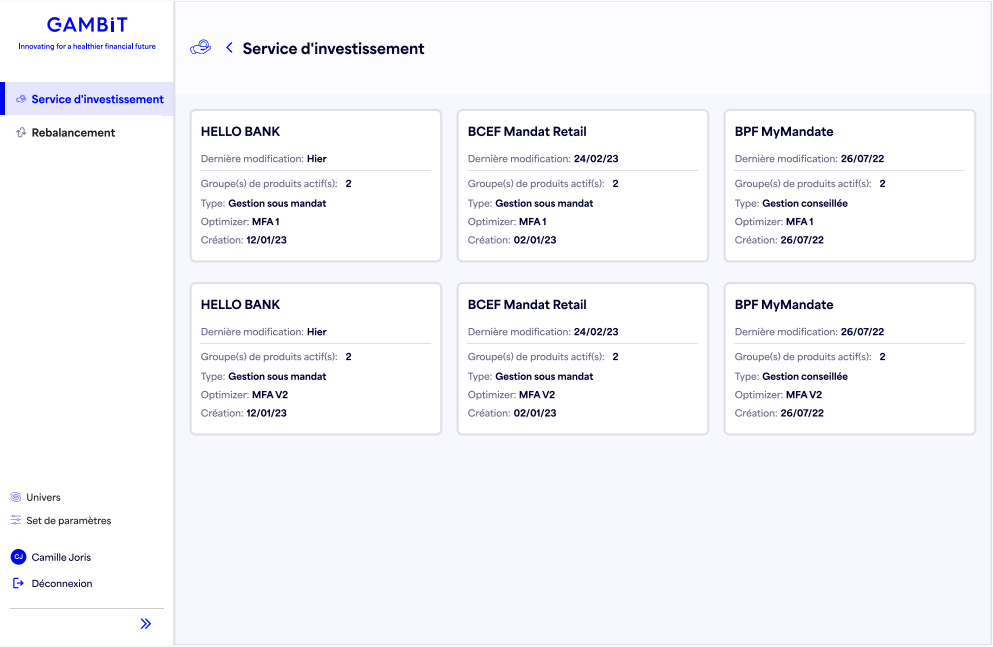

- Administration Console – configure and manage modules and workflows.

Yes. The platform is modular, cloud-native, and API-first, allowing seamless integration with existing front-end interfaces and back-end systems. Institutions can adapt workflows, client segments, and regulatory configurations while maintaining data security and compliance.

The modules are highly customizable. Portfolio construction can use built-in or external engines, with quantitative or rule-based logic. Financial planning tools can be configured to match the institution’s advisory model, client segments, and operational needs.

Targeted Solutions are primarily designed for institutions rather than direct consumer use. However, institutions can deploy certain modules, such as robo-advisory flows, to serve retail clients through their own digital channels.

.svg)